What Policymakers Don’t Understand About Small Business

Entrepreneurship in the United States has been changing in ways that many people have not yet recognized. I’m working on a much more extensive piece on these changes (and have been for some time – more on that project in a future post) but as the Covid-19 crisis took root, it became clear to me and my writing partner, Elizabeth Macbride, that policy-makers fail to understand the nature of entrepreneurship and small business in America (from the composition of entrepreneurs to the types of businesses they are starting to the rise of the “gig” economy) and that this failure was causing them to miss the mark on programs they were implementing to help. Last week, Elizabeth and I wrote an OpEd published on CNBC that describes the confusing landscape that businesses face trying to navigate the federal aid landscape. Earlier this week we penned a follow-up that describes at a high level some of the changes in the American entrepreneurial landscape as well as the ways in which policy can and must be adapted to keep pace. The text of our latest OpEd is below.

Entrepreneurship in the United States has been changing in ways that many people have not yet recognized. I’m working on a much more extensive piece on these changes (and have been for some time – more on that project in a future post) but as the Covid-19 crisis took root, it became clear to me and my writing partner, Elizabeth Macbride, that policy-makers fail to understand the nature of entrepreneurship and small business in America (from the composition of entrepreneurs to the types of businesses they are starting to the rise of the “gig” economy) and that this failure was causing them to miss the mark on programs they were implementing to help. Last week, Elizabeth and I wrote an OpEd published on CNBC that describes the confusing landscape that businesses face trying to navigate the federal aid landscape. Earlier this week we penned a follow-up that describes at a high level some of the changes in the American entrepreneurial landscape as well as the ways in which policy can and must be adapted to keep pace. The text of our latest OpEd is below.

_________________________________

To save the US economy, policymakers need to understand small business 101

Policymakers in Washington, D.C., fail to understand fundamental changes in the U.S. economy and the ways in which entrepreneurship and the small business landscape have changed over the past few decades. That misunderstanding is leading to poor decisions and poor policy and will lead to a failure of current stimulus measures to reach critical parts of the struggling U.S. economy.

Thousands of small businesses are probably gone for good because of the failure of the federal government to act quickly enough. More will be gone soon if we don’t change our actions now.

The current programs, including the Payroll Protection Program authorized by Congress and the Main Street Lending Program from the Federal Reserve, seek to help small businesses and their employees. They sound good. But because of the way in which they are being implemented, they will fail to reach vast swaths of the American entrepreneurial landscape.

Take, for instance, the Federal Reserve’s $2.3 trillion in loans, announced last week. It does the right thing by, among other things, extending credit to banks involved in the PPP program. It also makes $600 million in loans available to “Main Street” businesses — “small and mid-sized businesses that were in good financial standing before the crisis, by offering four-year loans to companies employing up to 10,000 workers, or with revenues of less than $2.5 billion,” the U.S.Treasury said in a release.

But it doesn’t go far enough. It bases lending formulas on metrics that won’t result in typical businesses being able to access the capital they need, doesn’t include a forgiveness provision like the PPP, and still fails to address the needs of most sole proprietor businesses and the gig/freelance economy.

Most businesses have few employees

Some 90% of the typical businesses in America — a salon, corner shop, restaurant or fitness center, those hit hardest by the current crisis — employ fewer than 20 people, according to data from the Census Bureau’s Annual Survey of Entrepreneurs. If you include the 24.8 million businesses that are sole proprietorships, 98% of U.S. businesses employ fewer than 20 people. Overlapping with these businesses are the 57 million Americans who freelanced in 2018 (what’s popularly termed the gig economy), according to the Upwork: Freelancing in America Survey. The current programs aren’t built for these businesses and aren’t accessible to them because the programs are based on payroll and are being administered through banks.

Drilling down on small business demographics

Here’s another misunderstanding: America’s small business owners aren’t white males anymore. The entrepreneurs of the future are women, people of color and immigrants (who are also the entrepreneurs of our past). The number of women-owned businesses increased 31 times between 1972 and 2018, according to the Kauffman Foundation. Meanwhile, the fastest-growing group of entrepreneurs within women-owned businesses are women of color, who are responsible for 64% of the new women-owned businesses being created. Immigrants start businesses at twice the rate of native-born Americans.

These shifts raise all kinds of questions for the stimulus and the recovery. Women and people of color are less likely to have relationships with traditional banks and the SBA, which have been the center of the stimulus package so far. Small businesses generally, and women-owned businesses specifically, are much more likely to make use of contractors. Early guidance by the SBA indicated that contractors would be included in the calculations of payroll, but final rules exclude them.

This not only lowered the amount of aid many small businesses qualified for, it also left these employees to fend for themselves through state unemployment system not structured for freelancers and the gig economy. Additionally, for many small businesses, rent, utilities and inventory outweigh payroll.

By pegging lending formulas on this single statistic, the PPP fails to address in any meaningful way the needs of most American businesses. The key feature of the PPP is the forgiveness of the loan amounts if certain employment metrics are met. This again leaves most businesses — and critical businesses such as restaurants, corner shops and hospitality businesses, all of whom have shut down indefinitely — without access to the program’s most important aspect.

The sheer magnitude of the problem makes it almost impossible for the SBA and its banking partners. In 2018 the SBA generated approximately $30 billion in loans. Under PPP the SBA was originally tasked with doling out more than 10 times that amount — in a period of weeks, not months, and the sums are growing.

In the early weeks of the crisis, the lenders with the best connections to people in need in their communities, community development financial institutions, were quickest to set up loan funds and have been meeting fundamental needs. But some weren’t included in the bill. Nearly a month into the crisis, the U.S. Treasury finally enabled financial technology firms to become lenders. This is a positive step, and more like it, which will allow broader distribution of funds available, need to be taken.

But beyond that, the programs themselves need to be expanded to offer more assistance, and assistance based on need beyond that calculated by the limited metric of payroll, to more businesses.

If we don’t get this right, we have the recent past for evidence of what will happen. During the Great Recession of 2008 and shortly thereafter, the net number of new firms created in the United States was negative: More companies closed than were being started. The result was 117,000 fewer companies in 2014 than there were in 2007. Entrepreneurship rebounded, but only in a few places. In the 30 years leading up to the Great Recession, 80% of metro areas saw an increase in the number of firms annually (a period that includes prior recessions). This trend was completely reversed by the Great Recession, after which only 20% of metro areas have seen an increasing number of companies created.

Our entrepreneurial spirit unites America. When it falters, our divides grow.

Now is our moment to change how we’re handling the substantial need that exists across the American business landscape. It’s not about either/or decisions. It’s about rebuilding the infrastructure of community finance and taking advantage of all the assets and conduits we have to help small businesses. It’s about getting funds into the hands of America’s vast and diverse set of entrepreneurs who can help rebuild us out of this crisis.

Elizabeth MacBride is founder of Times of Entrepreneurship, a publication covering entrepreneurs beyond Silicon Valley. Seth Levine is managing partner of the The Foundry Group, a $2.5 billion venture capital firm in Boulder, Colorado.

Settling In

As we enter week 5 (yes – I had to go back to my calendar and count) of our Covid-19 self-quarantine I find myself alternating between the comfort of my new routine and the uncertainty of not knowing when this will all be over. And for that matter, what “over” in this context means (How quickly will things return to some sense of pre-quarantine normalcy? Is that even possible at this point? What things from my new quarantine life will I miss? Will we be out and about too soon and have to shelter in home again as the virus spikes back up?). It’s a lot to take in.

As we enter week 5 (yes – I had to go back to my calendar and count) of our Covid-19 self-quarantine I find myself alternating between the comfort of my new routine and the uncertainty of not knowing when this will all be over. And for that matter, what “over” in this context means (How quickly will things return to some sense of pre-quarantine normalcy? Is that even possible at this point? What things from my new quarantine life will I miss? Will we be out and about too soon and have to shelter in home again as the virus spikes back up?). It’s a lot to take in.

In many respects I’ve come to at least understand, if not embrace, my new quarantine life. I like not commuting and am getting used to that. I like having our family around. Really, truly around since no one is going to sports practices, music lessons, art class, etc. We’re hanging out a lot more (apparently teenagers want to talk to their parents more when they’re stuck at home – I’m not complaining, it’s been great to have dinner together every night and then hang out for an hour and just talk). As someone who typically travels a lot, a long stretch at home, seeing my wife and family every day, sleeping in my own bed, and surrounded by my stuff (the longest period I’ve done that in as long as I can remember) is really nice. It’s been grounding in a way that’s been comforting and good.

But at the same time I also feel a sense of foreboding and disconnectedness. I don’t really know what’s going on in the outside world that much (aside from occasional trips to the grocery store and some drives with our “learning to drive” teenager around town, we’re not getting out at all). I’m worried about the economic consequences of our prolonged time at home is having on our country. I think a lot about those who are disadvantaged, who have no choice but to venture out to keep their jobs. And of those who have lost their jobs. We’ve been trying to help on those fronts as well (both with time – Greeley has been volunteering at the Boulder homeless shelter, for example; and with financial resources – especially targeted to local organizations helping feed and shelter those with the greatest need). But it can feel overwhelming at times. The Harvard Business Review had a great article on this: That Discomfort You’re Feeling Is Grief.

With the initial frenzy and adrenaline rush behind us, the term that keeps coming to my mind is “settling in”. The newness of being at home, the frenetic pace of the first few weeks of the pandemic, the quick and meaningful decisions that needed to be made, the novelty of a new “office” set-up, have all died down. I’ve been thinking a lot about what this means and how to best keep motivated as what had been a sprint settles in to something else.

I’ve recognized that I can’t keep sprinting. I’ve very much been in the mindset that I’ll do everything I can/need to do now and will figure out how to take a break later (spring break canceled wasn’t much of a bother with this mindset, nor were the long days or the working every day of the week). But I’m coming to realize (and share with the people I work with) that we need to settle in to something more manageable.

That’s not to say that there isn’t an incredible amount of work to do – there is. But settling in means figuring out a work pattern than provides some boundaries and balance. For those of us new to working at home those boundaries have been elusive (I’m speaking for myself here – I’ve found that hard). Stepping away for periods of time (I started by leaving my phone in my closet for the afternoon this past Sunday – a small but helpful step) is important. As is designing a work cadence that feels more manageable and less crisis/interruption driven. For companies, I think this starts at the top – CEOs recognizing that their employees are looking to them to model this behavior and help the organization as a whole settle into something more balanced and regular. For individuals, this looks like more planned days and likely more free blocks during the day to catch up and be pro-active vs re-active.

For all of us, I hope settling in means feeling a calmness about what we can control and what we can’t and focusing more of our time on the former and less time reacting to the latter. I hope you’re all staying safe.

SBA PPP Loans Aren’t for Everyone

There’s a healthy debate going on right now at many VC firms about whether venture-backed companies should apply to the SBA’s Payroll Protection Program (The Information had a good article on this yesterday (paywall), and Albert Wenger from Union Square Ventures put up an excellent post on the subject here). This program is designed to help businesses struggling with the Covid-19 crisis retain employees and pay for critical infrastructure (specifically rent, mortgage and utilities). I wrote an OpEd piece for CNBC yesterday with Elizabeth Macbride that outlined a number of ways that the program, as currently implemented, is failing to reach many of the businesses it was intended to support. The program is complicated, being implemented through only a subset of the banking sector, is being interpreted differently by different banks, and has a loan forgiveness formula that leaves out many critical businesses that are in desperate need of the money (specifically restaurants and hospitality businesses).

There’s a healthy debate going on right now at many VC firms about whether venture-backed companies should apply to the SBA’s Payroll Protection Program (The Information had a good article on this yesterday (paywall), and Albert Wenger from Union Square Ventures put up an excellent post on the subject here). This program is designed to help businesses struggling with the Covid-19 crisis retain employees and pay for critical infrastructure (specifically rent, mortgage and utilities). I wrote an OpEd piece for CNBC yesterday with Elizabeth Macbride that outlined a number of ways that the program, as currently implemented, is failing to reach many of the businesses it was intended to support. The program is complicated, being implemented through only a subset of the banking sector, is being interpreted differently by different banks, and has a loan forgiveness formula that leaves out many critical businesses that are in desperate need of the money (specifically restaurants and hospitality businesses).

Venture backed companies employ 2.7m people in the US according to the NVCA. There is no question that there are many venture backed companies whose businesses have and will continue to be significantly affected by the economic crisis that has been caused by Covid-19. These companies can and should apply through the SBA’s PPP program. But there are voices in the venture – and broader – community that believe every company in the US should apply for a PPP loan. That this is “free money” from the government. It’s not and at Foundry we think it’s a mistake to view it that way. While the rules of the program are unclear, vague and subject to interpretation and subjective opinion, there are a number of things that companies need to certify to be true about their business. They include:

- Current economic uncertainty makes this loan request necessary to support the ongoing operations of the applicant.”

- “The funds will be used to retain workers and maintain payroll or make mortgage, lease, or utility payments.”

We believe that many companies will look at their businesses and determine that there is a clear and real need for the additional funds offered through PPP. But we’re encouraging all of the companies in the Foundry portfolio to take a step back and consider whether they truly qualify for the program and whether their participation will save jobs and result in the business being less threatened by the crisis. We understand that there will be many companies that fall into a grey area. We don’t know today just how serious the economic downturn will be and just how impacted many businesses will become. Hard calls will need to be made but we’re encouraging companies to make them with thought and compassion.

Below is the email that we sent to our portfolio last Friday outlining our views on how they should approach this. We thought that it was important to share it more broadly.

_______________

Foundry CEOs & CFOs,

First of all, we can’t begin to tell you how impressed we’ve been with the leadership that you have all exhibited over these last several weeks. These are very challenging times both personally and professionally and these are the moments where true leadership is demonstrated. We sincerely thank you for the thoughtful and compassionate approach you have all taken during this crisis so far.

We had over 70 participants on the CARES Act/SBA/PPP call last night and we’ve had countless one-on-one conversations on this topic with many of you over the last few days so we know there is a lot of anxiety around the application process at the moment. The high anxiety levels appear to come from a mix of excitement and uncertainty which is certainly understandable because both components are clearly at play here. Although we can’t immediately relieve the anxiety, we strongly encourage you to take a few deep breaths and step back for a moment of reflection.

As you reflect, we think it is important to start by asking yourself “Was this relief package created for my company?” We’ve heard many of you talk about how attractive the economics of the loan could be for your company. The term “free money” has been tossed around more than a few times. We’ve also heard plenty of excitement around how simple it could be to qualify in part because the qualification requirements are both broad and ambiguous. However, the reality is that receiving a loan for your business means it isn’t going to another business that might also deserve the money so receiving a SBA loan does come at a cost to the broader small business community. Given the already mentioned ambiguity, we can’t, unfortunately, rely purely on the letter of the law to make this qualification decision for us. We all have to apply our social conscience and good judgment to come to the right answer. From Foundry’s perspective, we believe PPP was designed to accomplish two things:

Save jobs

Stop businesses from failing that are gravely threatened by the current crisis

No doubt that all of our companies would benefit from more cash with attractive loan terms on the balance sheet so it isn’t surprising that the majority of you are considering applying for the loan. At the same time, we know that many of you have not eliminated jobs or have no immediate plans to eliminate jobs at the moment. If you aren’t definitely planning to eliminate jobs, should you apply? Will your business likely fail without this loan?

As the application process is currently written, you (and perhaps your affiliates) will have to certify “Current economic uncertainty makes this loan request necessary to support the ongoing operations of the applicant.” This statement is highly ambiguous and could be interpreted in numerous ways. We’re sure most of you could easily rationalize this statement to be true. At the same time, providing false information in this application is a federal crime that includes jail time. In addition to your social conscience, you should have real conviction and certainty that you qualify in your own hearts and minds.

If you have a strong balance sheet, have recently raised money, or have some certainty around a near-term capital raise, we think you should reconsider applying. Although things are chaotic at the moment and it might be possible to take advantage of a lack of controls in the system, that doesn’t mean we should necessarily do so. Imagine for a moment that three years from now, the WSJ or FBI does a deep forensic analysis on the small businesses that received loans during the crisis. Would you feel good about the details of your situation being revealed in that process?

You are all proven leaders who have repeatedly demonstrated the ability to take a thoughtful and compassionate approach to decision making. While we all sort through the details and logistics of the loan application process, we encourage you to take a step back and remember to consider the big picture.

Thanks for reading.

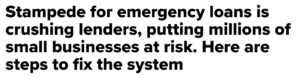

We’re Not Doing Enough to Help Small Businesses

Elizabeth Macbride and I wrote an OpEd piece that was posted on CNBC this morning addressing what we believe to be significant shortcomings of the CARES Act and the SBA’s Payroll Protection Program (PPP). Specifically how the stimulus is failing to meet the needs of small businesses around America in this time of crisis. This is urgent and needs to be addressed as soon as possible. I’d encourage you to click through to read the full piece, but below I’ve outlined the key recommendations we make at the end of the OpEd:

Elizabeth Macbride and I wrote an OpEd piece that was posted on CNBC this morning addressing what we believe to be significant shortcomings of the CARES Act and the SBA’s Payroll Protection Program (PPP). Specifically how the stimulus is failing to meet the needs of small businesses around America in this time of crisis. This is urgent and needs to be addressed as soon as possible. I’d encourage you to click through to read the full piece, but below I’ve outlined the key recommendations we make at the end of the OpEd:

1. Set up individual loan funds

Anticipating that the federal aid would roll out slowly, states, communities and foundations have set up their own loan funds, often with donations, community reinvestment act credits from local lenders and help from local economic development groups. There are more than 30 so far nationwide, such as this one in Louisville, Kentucky, that aims to put 0% interest loans into the bank accounts of businesses with fewer than 10 employees within a week. SBA funds could be disbursed to these loan funds, which have lines of communication to their own small business communities — and can act much faster than the federal bureaucracy.

“We are disappointed in the lack of broader inclusion of community loan funds in the PPP and are hopeful that we can find a way to be partners to reach all Americans and the businesses and nonprofits who are not easily reached by the larger institutions,” says Lisa Mensah, CEO of the Opportunity Finance Network, the association of community development financial institutions, which are involved in some of the new loan funds.

2. Urge big business to pay receivables faster

Big companies that market to small businesses and use their services are beginning to step up, by paying their receivables faster. Last week a coalition of tech companies that serve the small business market —Alignable, Fundbox, Gusto, Homebase, Womply, SmallBizDaily.com, Actual.Agency, Business.com and Small Business Edge — introduced an initiative called #paytoday to urge big businesses to pay faster.

Let’s encourage a national movement around this. It’s our respective civic duty as individuals and businesses to do everything we can do to support the small businesses in our communities.

3. Appoint a clear leader

Whatever interagency rivalry hampers the interpretation of the rules and implementation of the programs needs to stop. This is management 101. The mobilization needs a clear leader, who will be held accountable for making sure these billion-dollar programs run smoothly and transparently. President Donald Trump should appoint such a leader immediately to oversee these programs.

4. Provide more clarity

The PPP loan program needs immediate clarification and to be streamlined. That should be the first priority of the newly appointed Coronavirus Recovery Czar.

5. Expand the program

Additionally, the program itself needs to be expanded. The intent of the program is to save jobs and to provide a lifeline to businesses most affected by the COVID-19 economic crisis. However, the way it’s structured almost completely leaves out businesses such as restaurants, fitness facilities and other small businesses unable to operate in our current “shelter in place” society. Those businesses closed weeks ago and already laid off employees.

These businesses are unable to access key parts of the program related to loan forgiveness: For instance, the ability of loans to be forgiven based on future payroll obligations cannot be accessed if companies have already closed and laid people off and are unable to reopen quickly enough. These rules need to be addressed and updated to allow businesses such as these to receive the benefit of the program as they ultimately get up and running again as society emerges from their homes.

Meet your COVID-19 CFO

A lot of companies are struggling to figure out how to respond to the economic crisis that was precipitated by COVID-19. Should they cut staff or should they furlough them (and what’s the difference)? Should they ask people to take a pay cut? How much should they be cutting back on marketing and other expenses? What can they negotiate with their landlord? What are the federal programs that might support their business through this? How can they apply for the new PPP (Payroll Protection Plan) SBA loans?

A lot of companies are struggling to figure out how to respond to the economic crisis that was precipitated by COVID-19. Should they cut staff or should they furlough them (and what’s the difference)? Should they ask people to take a pay cut? How much should they be cutting back on marketing and other expenses? What can they negotiate with their landlord? What are the federal programs that might support their business through this? How can they apply for the new PPP (Payroll Protection Plan) SBA loans?

It’s a lot to take in. At Foundry we’ve been having daily briefings, calls and email updates with our portfolio to try to stay on top of it. That’s great for the companies that have access to resources like this, but what should you do if you’re a small business that isn’t a part of a network like ours? The vast majority of small businesses aren’t venture-backed. The vast majority don’t have a CFO or senior level financial professional to help them out.

Today we’re launching the COVID-19 Finance Assistance Network (yes, it was named by finance pros, not marketing ones…). In partnership with Lew’s List (which those in the Denver area will know is a long time networking and finance jobs group with over 11,000 members run by Lew Visscher) and High Plains Advisors (a local advisory services business). We’ve assembled a group of experienced CFOs, controllers and other finance professionals to help small businesses navigate through the crisis. It’s a free service – people are volunteering their time to help out.

If you’re a business looking for help you can click through the link above, fill out a short form with some basic information on your company and we’ll get in touch with you to connect you to a financial pro who can help out.

Please help us get the word out about this. This is open to all businesses who have been affected by the COVID-19 economic crisis (restaurants, retail, services companies, etc). I recognize that many of these companies will be outside of our traditional networks (and geographies). Let’s make sure they know that this service is available to them.

Investing in Downturns

TBH, I haven’t been thinking much about new investments at the moment. I’ve been asked many times how I think the Covid-19 crisis will change investor behavior and fundraising for startups. I generally give the kind of answer I think most VCs give and say something about how we all know that down markets are great markets for companies to grow (lots of great companies have been started in downturns), that there’s a lot of capital sitting on the sidelines at the moment and that capital will have to be invested, etc. All true, but I think not entirely well thought through in most cases.

For example, I also generally point out that despite most investors saying this, the vast majority are hitting pause on new investments for a bit (say 1-2 months, but who really knows) while they both focus on their existing portfolio and the decisions that need to be made in the near term about cash preservation, PPP loans, etc. and while they evaluate the overall markets and just how deep the crisis will go. Additionally, as a general rule, funds with larger portfolios are more likely to be on lock-down for new investments. Funds with smaller portfolios are more likely to be looking at new deals. Everyone is being cautious about valuations. Anecdotally, I’ve heard that early stage valuations are already down 30-50%. It’s early and not clear where this will end up, but I’ll keep my eye on it and will report here what we’re seeing.

For those of you who are regular readers of this blog, you’ll know that I love data and have several times pulled data from Correlation Ventures (who have a huge proprietary database of venture financings dating back decades which they use to power their investment decisions) in an effort to answer interesting questions about the business and practice of venture capital (my favorite such post is here). Yesterday they put up an interesting post providing some actual data to back up the broader statement that downturns are good markets to invest into (beyond the headlines of great companies that were started in downturns – that’s great but anecdotal; this analysis looks at overall returns post downturn).

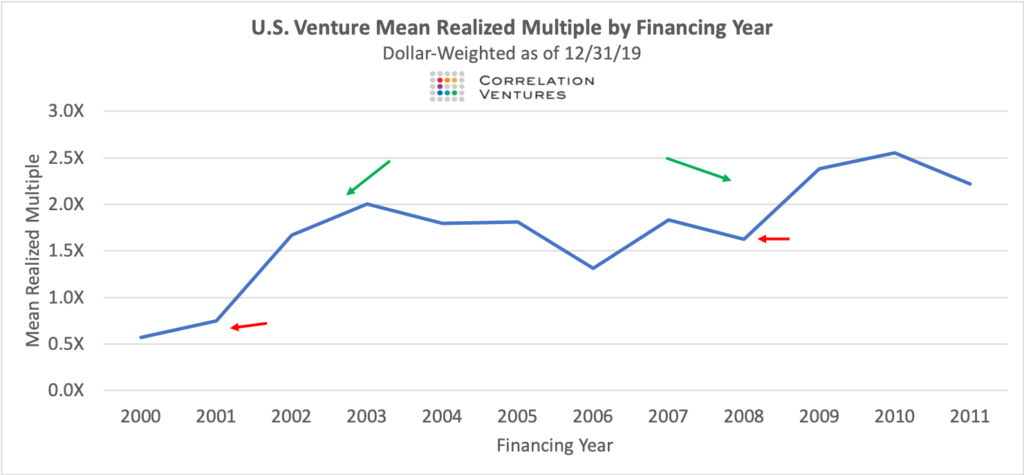

First, the overall trends, which show both a steady increase of returns post the 2000 bubble and show the specific increases post 9/11 and post the 2008 market crash.

Here’s a bit more detail on investments made the year before each of these downturns and the year after the downturn. Obviously, better to invest after.

For starters, both of these graphs are good reminders that “average” performance in venture isn’t great. That’s always been true, but every time I see a graph like this it does cause me to do a double-take (the graphic below from a recent post I wrote reinforces this). It’s a good reminder of the overall risk of the asset class and, frankly, just how hard it is to generate consistent positive returns (more on that here). But the data are clear that average investment returns increase in the years after a downturn (although part of the lesson here is clearly not to lean in too quickly). That should make anyone thinking of starting a business feel good. But the same trends that make downturns a good time to start businesses also make it a good time to invest in existing businesses (the Correlation data look at all financing rounds, not just first time financings). Access to capital can be tighter (but we’ll see in this case with unprecedented amounts of capital sitting undeployed), but competition for talent is typically reduced. Marketing expenses are lower and customer acquisition costs typically are reduced. Focus can be sharper with fewer market distractions as well as the pressure that comes from having somewhat more limited margins within which to operate. As we emerge from this, it can be your moment.

Markets are always cyclical and although we’re dealing with unprecedented times, the optimist in me knows that over time we’ll dig our way out of this. And that downturns are pretty good times to be building amazing businesses. Stay safe out there.

Tips For Working from Home From The Foundry Network

Over the past week I’ve been gathering work-from-home tips from Foundry Group portfolio companies. Here are some of the best suggestions – from WFH veterans as well as some newbies quickly getting up to speed. I highlighted a few that I thought were particularly good ones.

Over the past week I’ve been gathering work-from-home tips from Foundry Group portfolio companies. Here are some of the best suggestions – from WFH veterans as well as some newbies quickly getting up to speed. I highlighted a few that I thought were particularly good ones.

Work Space

- Create a dedicated work space distinct from high traffic or personal areas. Make sure that it’s uncluttered, professional and comfortable. You will also want to have good lighting and A/V accessories. If a dedicated space isn’t feasible, get creative and find some workable nook in your home where you’re comfortable and can focus.

- Listen to some music. If you’re in a lot of meetings this can be hard, but try to squeeze it in when you can.

- Invest in a good desk chair. Your back will thank you. Yoga balls are cheap, available for quick delivery, and ergonomically healthy. Note: I actually stole back into our office this weekend to get my standing desk and my back is already thanking me.

- Work near a window and keep it open. The cold air is a game-changer.

- Light your favorite candle in your office.

- (For CEOs and managers): If a critical employee needs something, get it for them. Make sure people are comfortable and can be productive. If a key employee needs a monitor or a standing desk, order it for them.

- Make occasional tweaks. Move things around in your WFH space and try something new each week. Over time you’ll discover little boosts from mixing things up.

- Not every task necessitates a laptop or sitting at desk. Can you take that next meeting from the couch, and use your iPad for your notes? Can the meeting after that be from your phone and headphones while you take a walk?

Routines

- Establish work routines that are similar to your in-the-office routines and will trigger you entering work mode. Start with a morning routine (breakfast, walk the dog) and ease into the work. Similarly, it’s helpful to wrap up the working day with a routine (touch base call or email, jotting down tomorrow’s to-do list or just closing down your computer for the day). This helps you keep the two modes separate.

- Take the time you normally would have spent commuting for a workout.

- If you have kids at home with you, establish ground rules for moving around the house and when and how you can be disturbed. Consider creating blocks of time dedicated for meetings or heads down time. By the same token, establish times when they know you’ll engage with them. That said, know that you’re in a fluid environment and chaos is bound to appear so embrace it with good humor when it comes. Note: I love that the new WFM culture embraces the occasional interruption on a Zoom or conference call from kids or pets. I’ve taken to asking my kids to come say hi when they accidentally step in on a call.

- Consider chunking up the work into bite-size intervals. Some prefer 60 to 90-minute periods while others like the shorter periods of 30 minutes. The important thing is to leave a space of time 5 to 15 minutes at the end of each period to take a break.

- Be disciplined about your calendar. This goes beyond faithfully calendaring your meetings. Set time aside for heads down work so colleagues will think twice about disturbing you. On the flip side, consider dedicating a block of time for catching up with people.

- Drink plenty of water. Not necessarily because water is good for you, but to replace those “water cooler” moments – Grab your phone when you head to the kitchen for water/coffee breaks and try to text a friend for a few minutes.

- Stop worrying if you’re doing it right. At home you’re the office manager, so you can change things up!

Communications

- Communicate, communicate, communicate. It is even more important in a remote environment. Use video calls as much as possible. They create a sense of community much more effectively than phone calls. To lighten things up and have a little fun, many video conferencing apps allow users to change their backgrounds. Try Gallery Mode on Zoom – it’s nice to see everyone’s smiling face in Brady Bunch mode. Also, don’t be afraid to converse on multiple levels. Chat can enhance and add nuance to teleconferences.

- Back-to-back video conferencing meetings are more draining than in-person meetings and leave little time for moving the body, staying hydrated, etc. Try shorter meetings 25 and 50 minutes, instead of 30 and 60 minutes to force people to have breaks during the day.

- Behave as if everyone is remote even if you have multiple people in the same location. Have everyone log into a video conference on their own individual computers. It levels the playing field and facilitates engagement by everyone.

- If something isn’t solved within 3 exchanges on Slack, jump on a Zoom. A face to face conversation usually sorts things out much quicker.

- Update your vocabulary. Out Of Office / OOO and Away from my desk are no longer meaningful in the COVID-19 era. Away from Keyboard is universally applicable.

Physical/Mental Health and Morale

- Encourage people to get outside. Spring is arriving so get out, breath in some fresh air, and soak in the energy from rebirth all around you (but keep social distancing rules in place, please!).

- Think about the fact that you’ve been given the gift of time and place. Sure, there’s a lot that’s out of your control, but you now have more control over your time and your immediate environment. In many respects, the pace of life has slowed down. Be selfish with this newly found time and spend it with the people with whom you are close – at home or virtually. Reach out to lapsed friends or family. Finish a project. Read a book. Make the best of it.

- Regulate the amount of news you consume and pick your times to check it. Many of us are news junkies. It’s easy to get distracted and even consumed by events in the world around us. While the new information is constantly coming to light, the overall narrative rarely changes.

- As a culture/excitement perk consider sending a little something to your team. Cookies or snacks help spirits stay high and give people a little surprise. Their families appreciate it too.

- Build social interaction into your work routines. Carve out opportunities for spontaneity with banter time at the start of regular meetings.

- Try 4pm “Happy Hour” meetings with no agenda. It’s a great way for the team to connect for 30min and bring everyone back to their workstations if they got distracted for some reason. You can also try “crew time”: lunches or yoga. Trivia or Jackbox games over Zoom are also fun. Slack has apps like Poke or Donut that encourage ad hoc engagement.

Lots in here. And lots more that I’m sure others have discovered and are implementing (a quick Google search reveals a number of blog posts and articles on this subject). Remember, everyone is in the same boat. As for help if you’re struggling with the new reality. And remember to stay connected.

Some additional jobs resources

A few more quick thoughts building on my Job Hunting in a Time of Crisis post from a few days ago:

Here is a link to a spreadsheet that lists out remote jobs as of Feb (there are 1575 on the list).

Ross Freeman sent me this link to “100 Developer Jobs – Companies still hiring amid the coronavirus crisis”

Mike Volkin suggested targeting industries like Health and Wellness, EdTech (online education and remote learning) and even remote collaboration tools to keep staff and teams aligned (i.e.Zoom and Slack). Can you provide services to companies in these industries. And for business owners, bring your business online (we’re already seeing this in personal fitness, coaching, medicine, etc).

And, of course, in case you missed it we launched the Colorado #COVID-19 Talent Network yesterday.

Keep the ideas coming in!

CO #COVID-19 Talent Network

With so many jobs being lost to the COVID-19 crisis a group of us thought it would be helpful to put together a talent network to help support those looking for work during this challenging time. We know there are companies out there hiring, and that includes tech companies. The Colorado #Covid19 Startup Talent Network provides job seekers access to upload their profile information and job skills. It also allows companies to search for talent and sort on various job criteria.

With so many jobs being lost to the COVID-19 crisis a group of us thought it would be helpful to put together a talent network to help support those looking for work during this challenging time. We know there are companies out there hiring, and that includes tech companies. The Colorado #Covid19 Startup Talent Network provides job seekers access to upload their profile information and job skills. It also allows companies to search for talent and sort on various job criteria.

Please share this network so we can get the word out. You can use this bitl.ly shortlink for ease: bit.ly/COCovid19StartupTalent.

You can also quickly share through social media with this ClickToTweet link: https://ctt.ac/fbncf

A few thoughts as we launch this. We know it’s rough. Our goal was to get a basic set of capabilities launched as quickly as possible. We also know that the need beyond the startup/tech community is great. We started with tech because that’s what we know. We’re looking for help to stand up other versions of this database and create Talent Networks for other industries (Retail, Hospitality and Restaurant are urgent, but there are others). If you’re interested in helping make that happen you can reach out through the “contact the organizer” link on the Talent Network site or just email me directly (we need some people with some technical talent who can create the data fields and host the networks).

A number of people helped get the Talent Network ready to launch. First and foremost, Micah Mador from Foundry, who set up the database in Airtable, created the splash page and is maintaining the network itself.

Others provided valuable feedback to earlier versions of the Network. At Foundry this included Jason Lynch and Jaclyn Hester. Also, Kendra Haberkorn, Jennifer Goldman, Marc Nager, Jennifer Shedd, Jon Landau, and Natty Zola.

And thanks to all of you for getting the word out.

I’ll update this post as we get additional versions of this Network launched.

And while we’re calling this a Colorado network (mostly because it was created here), we recognize that most jobs at the moment are remote and many will remain that way. We’re not trying to put any artificial geographic boarders around this – but do want to recognize the limitations of what we’ve so quickly built.

Job hunting in the midst of a crisis

My posts last week (which included predictions of pending lay-offs at technology businesses) prompted a number of people to reach out and ask a variant of the question: “How can I find a job in the middle of a shutdown/meltdown?”. I don’t know that I have a great answer to that but I thought I’d take a stab at it with the hope that some of these ideas will be at least somewhat helpful to those that find themselves in the position of being out of work during this crisis.

My posts last week (which included predictions of pending lay-offs at technology businesses) prompted a number of people to reach out and ask a variant of the question: “How can I find a job in the middle of a shutdown/meltdown?”. I don’t know that I have a great answer to that but I thought I’d take a stab at it with the hope that some of these ideas will be at least somewhat helpful to those that find themselves in the position of being out of work during this crisis.

TBC, while we’ve already seen a number of layoffs, I think there unfortunately are many more coming. Early lay-offs were widespread in the hospitality, travel and related industries. We’re just starting to see these in the tech sector – especially for companies that have exposure to travel and hospitality. I think we’ll see many more as companies get their hands around the cost cutting measures that will be required for them to weather this crisis and (hopefully) stay in business. I wrote the other day about companies considering measures such as covering a few months of COBRA and/or allowing for longer stock exercise periods as some tools they can use to help mitigate the pain, but the reality is that being out of work right now is challenging and something that millions of Americans are going to be dealing with over the coming month. This advice is focused on people working for tech companies, as that’s the world I know. Some of the advice is applicable outside of that sector, some not.

Don’t Panic. That’s my first advice for just about every situation and in this case it can be significantly easier said than done. But it’s important in this case, even though your emotions and fear may be running high. Take it one step at a time, form a plan, then get out there.

Companies are still hiring. Yes it’s true that many startups are locking down hiring (and that’s been the VC 101 advice that most investors – including Foundry – have been giving in general to their portfolio companies). But most are still hiring for at least some key positions. There are many companies that are actually seeing an uptick in business (sustainable uptick, not just the near-term “WFH” bounce that many saw last week into this).

Focus your profile/resume on return on investment. More than typically, companies are measuring return on all their spend. Crisis brings focus and focus brings out the data analysts to measure everything. This is probably a good thing (as long as eventually budgets free back up for experimentation) but it’s something you should have in mind as you think about how to best position yourself for another role. Be clear that you fit into this paradigm of measured expenditure. You’re comfortable with it; you’ve done it before; you think everyone should be measuring return and focusing their dollars (whether marketing, sales, development, etc) on those things with the highest near term return.

Expand your geographic focus. Everyone is working from home so at the moment we live in a “post-geographic” world. Might not be the first thing you think about when you’re starting to look around (maybe in this environment it is, so sorry if this is obvious). Go broad and don’t worry about location. Most companies are much more open to WFH as a longer term prospect now that they were 2 weeks ago.

Get your Zoom game on. It’s not ideal to interview over Zoom, but that’s today’s reality. Make sure you show up like a pro. And embrace it – it’s the new normal.

Keep at it. Lots of companies that put hiring on hold a week ago will have a better sense for how their business is really being impacted over the next few weeks (and to be clear, most companies are making week-by-week assessments). Pace yourself and keep at it. Companies are changing their views continually through this and what their plans are today (no more hiring) may be completely the opposite a week from now.

I’ll keep thinking about this and will post updates. I know this isn’t a great time to be looking for a job. But markets are cyclical and I know that we’ll ultimately recover from this.